Why is Your Foreign Credit Report Important?

How it Works

Have you recently received an email requesting access to your foreign credit report?

-

.

.STEP 1

.STEP 1Are you a New Expat in UAE?

Etihad Credit Bureau enables new expats like yourself to increase your eligibility by providing lenders with visibility on your foreign credit report.

-

.

.

STEP 2Apply for a Credit Facility

As part of the lender process, you will be required to provide access to your foreign credit history.

-

.

.

STEP 3Unlock your Foreign Credit Report

The lender will ask Etihad Credit Bureau to obtain your foreign credit history by sending an email to you requesting your consent to access your foreign credit report.

-

.

.

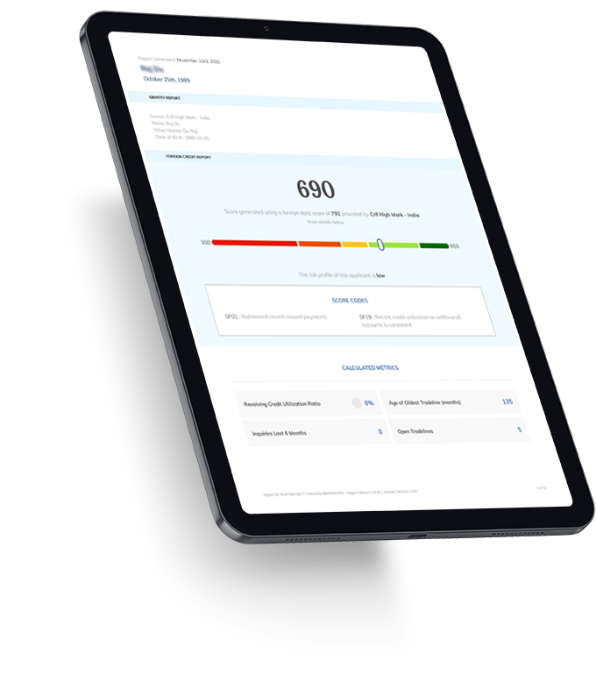

STEP 4Retrieve Your Foreign Credit Report

After completing the verification process and within a seamless secured transaction, your foreign credit report will be instantly shared with you and your lender.

-

.

.

STEP 5Lender Reviews your Credit History

Your lender will then use your foreign credit history to assess your credit application.

Have a Question or Need Support?

Visit the FAQ section to learn more about Foreign Credit Reports

Learn More